Online Calculator for Personel Loan EMI and interest

What is a personal loan?

A personal loan is a type of unsecured credit. Which is offered by financial institutions such as a bank or non-banking financial company (NBFC). Personal loans are granted based on your credit history and ability to repay from personal income. It is also known as consumer loan. This is a multi-purpose loan, the sole purpose of which is to meet individual needs.

What is a personal loan EMI?

Equal Monthly Installment (EMI) is a method of paying the principal amount and loan interest on a fixed monthly basis until the loan is fully repaid. Each EMI payment includes both the principal loan amount and the interest charged. With the advantages of relatively less processing time and minimal paperwork, a person has to meet requirements like good credit card score and take care of high interest rates.

What is a personal loan EMI calculator?

Personal loans are unsecured loans given to people for various personal reasons, such as paying off debts, meeting wedding expenses, unforeseen medical expenses and other financial needs. The personal loan EMI calculator helps you to know the loan installment that needs to be paid at regular intervals. It enables you to evaluate the total outflow in terms of loan.

How can EMI calculations be helpful?

The EMI calculation gives a clear assessment of the amount that needs to be set aside to pay the monthly installment. Which enables you to make an informed decision about loan outflow every month. So, knowing the amount of EMI helps you plan your expenses properly, while knowing how much you need to keep for it on a monthly basis.

Benefits of EMI loan checking

- Affordable assessment of loan

- Determining the amount and duration of the loan

- Plan a loan repayment

- Pre-payment planning

- Benefits of personal loans

- Personal loans can be taken for many personal reasons. like

- To meet the cost of expensive weddings.

- To make any big purchase.

- Medical Emergency.

- For building renovation.

- For credit card debt settlement.

- For business or work related investments.

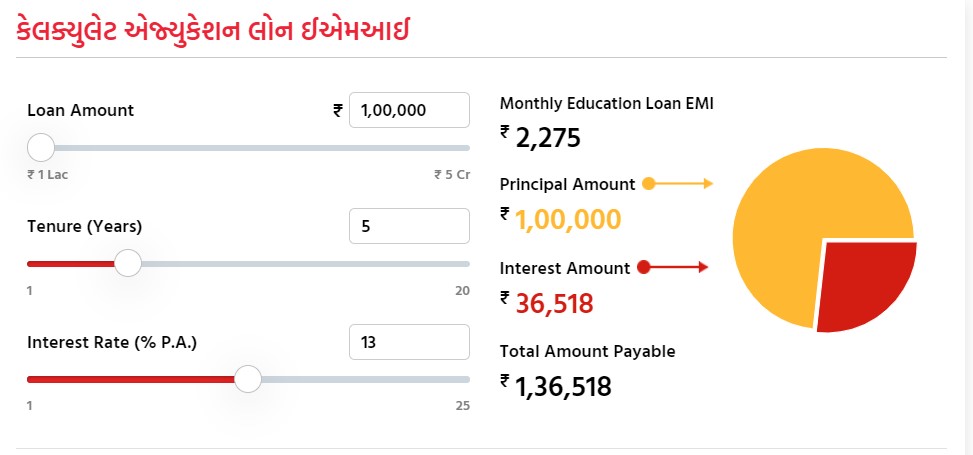

How does consumer loan EMI Calculator Work?

Personal loans have fixed repayment tenure with monthly repayments referred to as EMI (equated monthly installments) that require to be remodeled the whole loan tenure. EMI calculator may be a tool that helps you calculate your loan EMI supported some key data like the quantity borrowed, rate of interest applicable to the loan and tenure. you'll use the EMI calculator freed from charge any time of the day and unlimited number of times to calculate consumer loan EMI that matches into your budget.

Procedure to Use consumer loan EMI Calculator

The personal loan EMI calculator on Paisabazaar’s website uses some key information provided by the user to point out the EMI amount instantly

. the subsequent may be a step-by-step guide regarding the way to use the calculator:

- Step 1. Once you've got logged on to Paisabazaar’s consumer loan EMI calculator page, input your required consumer loan amount.

- Step2. Provide the expected consumer loan rate of interest

- Step3. Provide the tenure over which you would like to repay your loan

On completing the above steps, your consumer loan EMI is displayed instantly. Additional details you'll view include total interest payable and therefore the total amount payable (loan principal + interest).